Wood on Plastics: Demand for Medical Products Continues to Expand

The healthcare industry has received a lot of attention recently.

The healthcare industry has received a lot of attention recently. Aging baby-boomers, skyrocketing costs of health insurance, and the rancorous debate over the federal government’s enormous healthcare reform legislation have dominated the national headlines over the past few months. It is reasonable to assume that all of these issues will impact plastics processors for years to come. But my guess is that these are not the main reasons that virtually all segments of the plastics industry are increasingly interested in the healthcare market.

I suspect the main reason that the manufacturing sector is paying so much attention to healthcare is money. Even in the midst of the recent economic recession, the medical products segment was expanding and profitable. Yes, that’s right. While suppliers to the motor vehicle, construction, appliance, consumer products, packaging, and even electronics sectors were struggling to survive, the guys making medical supplies and equipment were getting bigger and busier. And there is a strong indication that this trend of the medical industry outperforming the overall average will continue.

There are two ways we can measure and forecast the trends in medical products. The first is to look at consumer spending patterns for these products. According to data from the Commerce Department’s Bureau of Economic Analysis, consumer spending for therapeutic medical equipment expanded by an inflation-adjusted average annual rate of more than 5% during the past five years, and it even showed a small increase in 2009. Spending for other non-pharmaceutical medical products also grew by 5%/yr during this period, including a rise last year.

By comparison, spending for all other types of goods consumed in the U.S. grew by just over 1%/yr during this time frame, and 2009 consumer spending for non-medical goods declined by 2%. So in both good economic times and bad, American consumers are steadily allocating more of their resources to medical products.

This trend of increased consumer spending is spurring growth in the output of medical products from U.S. factories. The total volume of medical supplies and equipment produced in the U.S. expanded by 3% in 2009 when compared with the previous year. This is a sharp contrast to the 10% decline in total factory output for all other industrial products. In the first quarter of 2010, the output of medical products was up 5% compared with a year ago, and our current forecast calls for this rate of growth to continue all year.

So we are clearly in the midst of a boom in medical products, which should continue for the foreseeable future, fueled by a combination of favorable demographics and a flurry of technological innovation in the U.S. and Europe. Emerging markets in Asia and Latin America will also generate increased demand due to the combination of new technologies, better access to existing medical products, and the increased use of the packaging needed to ship and store these products in uncertain and far-flung environments.

WHAT IT MEANS TO YOU

Demand for medical products has been driven historically by the desire to save lives. This will continue to be a major factor, but it will become increasingly necessary for designers and suppliers of medical products to also save money. Plastics have many advantages here.

Manufacturers of medical supplies and equipment must develop a close relationship with all the links in their supply chain. Just one global recall or class-action lawsuit could bankrupt most small to medium sized processors, so you better know exactly what you are producing and shipping.

Disposal issues, recycling, and other facets of the “green” or sustainable movement will increasingly affect medical products, so processors should stay informed about the associated costs.

Related Content

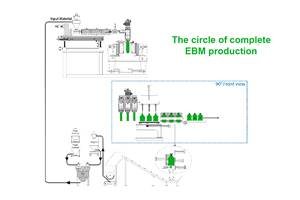

Get Color Changes Right In Extrusion Blow Molding

Follow these best practices to minimize loss of time, material and labor during color changes in molding containers from bottles to jerrycans. The authors explore what this means for each step of the process, from raw-material infeed to handling and reprocessing tails and trim.

Read MoreLatest Data on Bottled Water Shows Continued Strong Growth

Bottled water’s volume surpassed soft drinks for the first time in 2016 and has done so every year since.

Read MoreMultilayer Solutions to Challenges in Blow Molding with PCR

For extrusion blow molders, challenges of price and availability of postconsumer recycled resins can be addressed with a variety of multilayer technologies, which also offer solutions to issues with color, processability, mechanical properties and chemical migration in PCR materials.

Read MoreFoam-Core Multilayer Blow Molding: How It’s Done

Learn here how to take advantage of new lightweighting and recycle utilization opportunities in consumer packaging, thanks to a collaboration of leaders in microcellular foaming and multilayer head design.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More