Pressure Building in Packaging

Wood On Plastics

There are many packaging related issues that are best solved, or can only be solved, by plastics products. This is where processors should concentrate their efforts.

The price of crude oil on world markets has been on a relentless upswing in recent months, and this is having a profound impact on both suppliers and consumers of plastics packaging. The bad news is that this trend of rising oil prices is not expected to reverse in any significant way for the foreseeable future. The good news is that the high cost of crude oil and its distillates (i.e. gasoline) should raise demand for many types of plastics packaging over the long run.

Looking first at the short-term prospects, the net result of rising oil prices on packaging processors is largely negative. First, resin prices are closely correlated to that of crude oil, and the fact that oil prices are at or near record high levels means that resin prices are also at record highs.

However, the cost of oil has generated a sharp increase in natural gas production in the U.S., and at some point in the not-too-distant future, resin prices will be more affected by the price of natural gas than by the price of crude oil. But this is not the case right now, so processors are still caught in the vice of high materials prices.

Another negative effect of high crude oil prices is that gasoline and diesel fuel prices are also quite high. High gasoline prices diminish the discretionary spending power of consumers and suppress consumer confidence. The high price of diesel fuel raises shipping costs for all types of goods, including consumer non-durables such as food, cosmetics, and health aids.

But not all of the effects of higher energy costs are bad for producers of plastics packaging. In an increasing number of cases, plastics products are far less energy intensive to manufacture than products made from glass, metal, or paper. Plastics products are lighter to ship and easier to fill and process.

Technological advances have recently created plastics packaging that extends shelf life of the package contents, is easier to use for consumers, and requires less refrigeration. Disposal and/or recyclability of plastics are also easier much of the time. All of these issues are made more acute by the continuing increase in oil prices.

Innovation in plastics packaging has accelerated rapidly over the past 10 years, and while this is far from over, it may hit some headwinds in the next few quarters. This is because innovation is directly affected by the amount of research and development in the industry, and these R&D activities are directly affected by profit levels. And as we mentioned earlier, profits are currently experiencing a bit of a squeeze. But this will only slow the innovation cycle, not stop it.

This brings us back full circle to the effects of high energy prices on consumers. As noted, they inhibit consumer spending in the short term. But over the long run it makes consumers far more conscious of issues pertaining to products that are more sustainable, recyclable, and biodegradable.

As most processors know, these are tricky issues because at the very least they involve a complicated three-step process. First, can a material or product be developed that solves all of the problems that are required of a package and still meet one or more of these sustainability objectives? Second, can this new material or product be manufactured on a viable scale? Finally (and perhaps most importantly), will it garner market acceptance? These are complicated issues, but the incentives for solving them increase with each uptick in the price of crude oil.

WHAT THIS MEANS TO YOU

•Many types of plastics packaging are currently under attack (such as bags and water bottles) and are actively being regulated or de-selected. This will continue for the foreseeable future.

•There are many packaging related issues that are best solved, or can only be solved, by plastics products. This is where processors should concentrate their efforts.

•Developing economies in Asia and South America represent huge and largely untapped markets for the next generation of plastics packaging.

Related Content

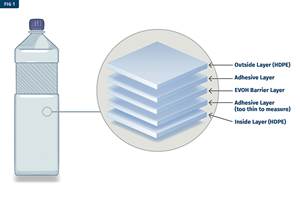

Measuring Multilayer Plastic Containers Made Easier With Today's Ultrasonic Gauges

Ultrasonic gauge technology has evolved to simplify measurement of very thin layers in plastic containers. Today’s gauges with high-frequency capabilities and specialized software can make multilayer container measurement quick and easy for ordinary users.

Read MoreUS Merchants Makes its Mark in Injection Molding

In less than a decade in injection molding, US Merchants has acquired hundreds of machines spread across facilities in California, Texas, Virginia and Arizona, with even more growth coming.

Read MoreFor Extrusion and Injection-Blow Molders, Numerous Upgrades in Machines and Services

Uniloy is revising its machinery lines across the board and strengthening after-sales services in tooling maintenance, spare parts and tech service.

Read MoreThin, High-Performance Nylon/PE Barrier Film for Thermoformed Packaging

Südpack’s Multifol Extreme film is well suited for greasy, protein-rich and frozen foods

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More