Appliance Output to Accelerate in 2014

Wood on Plastics

But this industry is still a long way from full recovery.

The economic fundamentals that underpin the appliance market are positive in the long term. The latest forecast calls for a gain of 8% in U.S. production of household appliances in 2014. This follows a rise of 6% in 2013.

These are pretty decent back-to-back annual gains, but as the accompanying chart illustrates, this industry is still a long way from full recovery. After the housing bubble burst in 2008, U.S. production of appliances was stuck at a painfully low level for more than four years. Things are finally improving, but a steep hill still needs to be climbed. At the current rate of growth (6-8%/yr), it will take at least another two years before the domestic appliance industry gets back to anywhere near pre-recession levels.

The key to domestic demand for household appliances will be the continued improvement in U.S. residential construction and real-estate markets. Both are currently in a well-established recovery phase, but the pace of expansion has decelerated in the second half of 2013. There are several reasons for this: slow household-income growth; difficulties accessing credit; rising interest rates; and uncertainty stemming from inept policymaking in Washington. All of these factors are expected to gradually improve over the coming months, so that recoveries in the residential-construction and real-estate sectors will regain momentum in 2014.

Another factor that processors who supply this market should be aware of is pent-up consumer demand. Despite the lackluster economy, appliances continue to be used at pretty much the same rate as always. Consumers do not cut back on their use of appliances during recessions—they just cut back on the purchase of new ones. What this means is that the average age of the appliances currently in use is quite high, and getting higher. The constant pressure to replace aging stock creates pent-up demand, and the release of some of this demand is starting to emerge.

As for global demand for household appliances, the fundamentals are just as good as, if not better than, they are for the domestic market. Global demand for appliances is expected to grow at 5-6% per year for the next four or five years. There is a burgeoning middle class in many developing nations. Household appliances are high on their list of wants and will likely account for a higher portion of household spending than in the developed countries of North America and Europe.

But the question remains, “Where will the world’s appliances be manufactured?” The U.S. is currently the biggest global market for household appliances. We have more appliances per household, and we purchase bigger and more technologically sophisticated appliances than any other country. But one of the implications of the accompanying chart is that our domestic appliance industry is withering, and it remains to be seen whether we can recapture our once dominant position. Though the demand fundamentals are all pointing upward in the future, the supply side is murkier.

WHAT THIS MEANS TO YOU

•Rising energy costs will continue to be a major factor in the market for household appliances. Appliances that use natural gas (dryers and stoves) may see higher demand in some regions.

•Reuse and recycling of appliances will increasingly become a factor in the market. The cost of appliance disposal is rising at a faster rate than the cost of the appliances themselves.

• Smart-phone savvy consumers increasingly will demand "smart" connectivity features in home appliances.

Related Content

BASF Delivers Biomass-Balanced Ammonia to Evonik

BASF’s BMBcert ammonia grade will be used by Evonik for production of nylon 12 and epoxy curing agents.

Read MoreHigh-Jetness Carbon Black for Engineered Plastics

Orion’s new Printex chroma 500 Beads are well suited for applications such as injection molded automotive parts and household appliances.

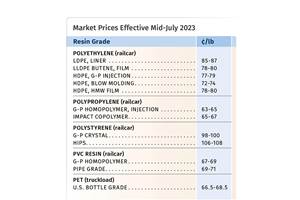

Read MorePS Prices Plunge, Others Appear to Be Bottoming Out

PS prices to see significant drop, with some potential for a modest downward path for others.

Read MorePerformance Nylon 6 and 66 Resins with High PCR/PIR Content

Syensqo has further extended its Omnix Echo portfolio of circular engineering resins with five new additions.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More