U.S. plastics machinery shipments on the rise

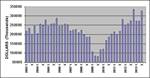

Deliveries of plastics machinery and equipment in the U.S. climbed 11% in the first quarter, a show of strength in a weakening global market.

Shipments of primary plastics equipment totaled $300.5 million in the first quarter, up almost 11% compared with the same quarter of 2013. The ’s (SPI) Committee on Equipment Statistics noted that “2014 is off to a good start”, despite a historical tendency for a first-quarter slowdown following a typically busy fourth-quarter buying push.

Injection molding machinery shipments increased 9% in the first quarter of 2014, compared to the year-ago quarter. Single-screw extruders shipment values rose 4%, while the shipment value of twin-screw extruders jumped 15%. The biggest gains came in blow molding machine shipments, which spiked 60%.

In auxiliary equipment, which includes robotics, temperature control, and materials handling, new bookings for reporting companies totaled $98.6 million in the first quarter: up 6% from year-prior levels.

In other industrial machinery sector metrics, 大象传媒 investment in industrial equipment rose by 5% in the first three months of 2014 compared to the start of 2013, according to the Bureau of Economic Analysis, while the Census Bureau found that the total value of shipments of industrial machinery jumped 29% for the quarter.

The CES’s quarterly survey of machinery suppliers contained responses that were “a bit more optimistic” than those given in the fourth quarter, according to SPI. Fully 93% expect conditions to stay the same or even improve in the coming quarter, while 88% expect them to hold steady or get better during the next 12 months.

North America, Latin America and Mexico are where the strongest gains are expected, on a geographic basis, while expectations slipped a bit for Europe and Asia. As for the major end-markets, automotive, medical and packaging will continue to be the strongest in terms of demand, while the appliance sector’s expectations continue to trend upward.

German machinery market flat

Germany’s VDMA reported that exports from the German mechanical engineering industry, including suppliers of plastics and rubber machinery, saw a .9% drop in exports in the first quarter, falling to Euro 35.7 billion. VDMA noted that a decline in the BRIC (Brazil, Russia, India and China) countries, felt most acutely in Russia, was offset by positive demand from the U.S. In the U.S., which is Germany’s second most important sales market behind China, deliveries rose by 6.6%. Overall, Germany maintained a trade surplus, with VDMA recording machinery imports of Euro 14.1 billion, up 1.6%, in the first quarter.

Asia weakened for Germany machinery suppliers, with shipments to China shrinking by 2.5%, while India retracted 11.7% along with dips in South Korea and Taiwan. There were some positives in the region, however, with Japan rising 3.2% while Thailand climbed 29.4% and Vietnam rocketed up 65.5%.

“The .9% decline in the first quarter of 2014 is disappointing,” VDMA noted in a release, “especially as 2013 was closed at an almost stagnant rate. In a generally difficult macroeconomic environment, however, demand for capital goods was weak.” That weakness has been exacerbated by the tensions in Ukraine, according to VDMA.

Related Content

-

Arterex Acquires Italian Medical Device Provider

Arterex’s acquisition of Phoenix S.r.l. continues its growth mission to offer customers in North America and Europe diversified, high-precision medical device manufacturing solutions.

-

Custom Molder Pivots When States Squelch Thriving Single-Use Bottle Business

Currier Plastics had a major stake in small hotel amenity bottles until state legislators banned them. Here’s how Currier adapted to that challenge.

-

What to Look for in High-Speed Automation for Pipette Production

Automation is a must-have for molders of pipettes. Make sure your supplier provides assurances of throughput and output, manpower utilization, floor space consumption and payback period.