PE Film Market Analysis: Shrink Film

Market growth potential for this film segment is described by most as ‘slow but steady.’

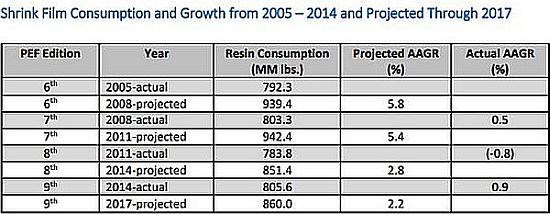

Last year, processors consumed approximately 805.6 million lb of PEs of various varieties to produce shrink film. With an average annual growth rate (AAGR) of 2.2%, PE resin consumption for the production of shrink film is expected to reach 860 million lb by 2017. The biggest application for shrink film is for unitization of consumer products, with new applications for constantly being developed. The public’s growing appetite for the convenience and cost savings of purchasing products in bulk has spurred the increase in demand, as has—relatedly—the continued popularity of superstores, warehouse stores, and wholesale clubs.

The physical characteristics required of shrink film include strength, puncture resistance, sealability, clarity, and excellent load retention. Some shrink film applications require coloring, ultraviolet light inhibitors (UVI), corrosion inhibitors, venting, varying coefficient of friction (COF) levels, anti-static additives, moisture barriers, printability, hot-tack strength, and controllable shrink or draw down percentages.

These are among the conclusions of the most recent study of the PE Film market conducted by ., St. Joseph, Mo.

The study notes that shrink films are classified by the amount of contraction or shrink percentage when heated in both the machine direction (MD) and the transverse direction (TD). The percent of contraction in the machine direction (MD) typically ranges from 50% to 70%, with 60% being the most common.

Contraction in the transverse direction (TD) typically ranges from 5.0% to 15%. Shrink films utilized for wrapping paperback books, magazines, and skin or blister packaged products with a cardboard backing require a soft shrink or low percent shrink film. Low force shrink films eliminate buckling or distortion of products and related packaging, according to the Mastio report.

MATERIALS TRENDS

The Mastio study reveals that LDPE resin remains the principal material of choice for the production of shrink film due to the resin’s high clarity and ease of processing. LDPE-homopolymer and LDPE-EVA copolymer resin grades are extruded separately, blended, or coextruded with other polyolefins for shrink film production. LDPE-EVA copolymer resins are often used to increase the shrink film’s clarity, low temperature flexibility, impact resistance and heat-seal properties. LDPE-EVA copolymer resin is well suited for shrink film and bags that require printing or freezing. LDPE-EVA copolymer resin also provides excellent adhesion when used as a bond layer in coextrusion or lamination with other heat-sensitive substrates such as BOPP film, because the film surface softens as the EVA copolymer content increases. Additionally, a small amount of LDPE-acrylic acid copolymer (LDPE-EAA) was also reported.

Mastio notes that other resins utilized in the production of shrink film include blends or coextrusions of LLDPE resins including butene, hexene, super hexene, octene (LLDPE-butene, LLDPE-hexene, LLDPE-super hexene, LLDPE-octene), and mLLDPE grades. LLDPE resins, alone, lack the physical characteristics necessary to produce shrink film.

More processors continue to use metallocene grades of LLDPE in the production of shrink film, according to the study. The metallocene process produces resins with very predictable performance characteristics that are extremely uniform and consistent. Improved film clarity and impact resistance, in lower gauges are some of the value-added benefits of using mLLDPE resin.

TECHNOLOGY TRENDS

Blown film is the preferred process of producing shrink film, because it allows the manufacturers to custom design film with the required percent of contraction. Control of contraction and orientation in both the MD and the TD is possible in blown film extrusion.

The cast film process, on the other hand, allows greater control of shrink film gauge uniformity, increased clarity, and higher output rates. Another benefit of cast film extrusion is the ability to produce shrink films with less shrink force in the TD, since most of the potential shrink force is limited to the MD. Shrink films produced with the cast film extrusion process are often called “low force” shrink films and are used for applications such as magazine overwrap. Over contraction of shrink films in those types of applications can cause the magazines to wrap or buckle when the outer packaging is heat shrunk.

Last year, coextruded structures accounted for about 61% of the market, states Mastio. Three-layer coex structures are most common, though some processors go up to seven.

MY TWO CENTS

Last year, Mastio reports, the industry’s top six shrink film processors held a collective market share of 60%. These are among the industry largest, most recognizable and most technologically advanced names in the film extrusion market, such as , , , AEP Industries, Inc., Sealed Air Corp. (Cryovac Div.), and Cove Point Performance Packaging (.). Most industry players categorized the market as “strong and stable,” with future growth depending on the overall economy (GDP).

Some of the smaller players are introducing new products for bulk packaging to reduce overall packaging usage. Others smaller players are looking at new markets and unique resin blends and combination in an effort to differentiate their product offerings. Market niches seem to suggest an opportunity for smaller processors to compete.

Related Content

What You Need to Know About Roll-Cooling Design

Cooling rolls might not look like high-tech machines, but the fact is there is a surprising amount of technology involved in their design, manufacture and use. Here’s what you need to know.

Read MoreBreaking the Barrier: An Emerging Force in 9-Layer Film Packaging

Hamilton Plastics taps into its 30-plus years of know-how in high-barrier films by bringing novel, custom-engineered, nine-layer structures resulting from the investment in two new lines.

Read MoreNovel Line Turns Fluff to Blown Film

Processor Bioflex of Mexico is utilizing Reifenhäuser Blown Film’s EVO Fusion technology to integrate postindustrial and postconsumer recycled materials into products.

Read MoreFollow These Tips to Fire Up Your Cold Blown Film Line

Firing up a cold blown-film line after a shutdown involves multiple pieces of equipment that all interact. Here’s a look at those components individually and some best practices on how to get your line up and running as quickly and safely as possible.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More