PE Film Market Analysis: Cheese Packaging

Market is projected to grow by 4.4% over the next three years. Coextruded blown film structures dominate.

Cheese packaging is designed to contain three major cheese types including natural cheese, powdered cheese and processed cheese. Natural cheese is manufactured from pasteurized milk with no secondary processing. Natural cheese is aged by manufacturers and continues to age on the shelf. Powdered cheese is natural cheese which is dehydrated and powdered for use as a flavoring in snack foods and other food products. Processed cheese is produced by squeezing natural cheese solids, which are ground and cooked with whey, water, salt, and emulsifiers to enhance shelf life and stability. The cooking process also pasteurizes the product and stops the aging process.

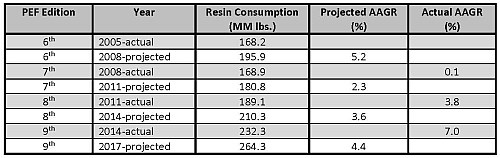

In 2014, 232.2 million lb of PE were consumed by processors making cheese packaging. Withan average annual growth rate (AAGR) of 4.4%, the cheese film market is projected to consume 264.3 million lb of PE resin by 2017.

These are among the conclusions of the most recent study of the PE Film market conducted by ., St. Joseph, Mo.

Natural cheeses require packaging with greater barrier properties than processed cheeses because natural cheeses are highly susceptible to outside aroma transfer and spoilage from exposure to oxygen, Mastio reports. The type of film utilized for natural cheese packaging depends on how long the cheese will be aged. Longhold cheese remains in packaging film for 60 days or longer during aging. Short-hold cheese requires greater gas barriers to help slow the aging process.

An exception to this is Swiss cheese, which is very gassy, so the film must allow gas to escape. Excess gas in Swiss cheese packaging will not harm the cheese, but consumers prefer that cheese film fits tightly around the cheese. Natural cheese film ranges in gauge from 2-5.0 mils, with 3 mils being the most typical, according to Mastio’s research.

Processed cheeses do not need a gas barrier because they are not aged; however, processed cheeses do require a grease barrier because of the emulsifiers used. Flex-cracking and hermetic seal requirements are less rigorous for processed cheese films than for natural cheese films. Some processed cheeses do not require refrigeration. Processed cheese film ranges from 1-3 mils in thickness, says Mastio.

MATERIAL ALTERNATIVES

In the past, polyvinylidene chloride (PVDC) films were sometimes used in the cheese packaging market, but in 2014 there was no reported usage of this material. PVDC films have higher hot fill capabilities than PE films and provide good gas barriers. However, as Mastio points out, PVDC resins are often more costly than PE resins, and do not always process as well as PE resins.

Oriented polypropylene (OPP) film is another polyolefin material utilized for this market and is often used for its moisture barrier properties. Additionally, oriented polyester film is substituted for OPP film when gas flushing is not a requirement. Processed cheese slices are often packaged with polyester film.

Foil substrates are also used in this market, and are often laminated to PE films, which add flexibility and strength.

During 2014, approximately 84.1% of the PE film for cheese packaging applications were manufactured using the blown film extrusion process, according to Mastio. The remaining 16.9% of PE cheese film was manufactured by the cast film extrusion process.

Coextruded film is most common in this market representing 81.1% of resin consumption. The number of coextruded layers can be as high as eleven, however, three-layer and five-layer structures are most typical for cheese film. In coextruded structures nylon and ethylene vinyl alcohol copolymer (EVOH) resins can be used with PE resins because they provide the required oxygen and gas barrier properties necessary. More sophisticated coextruded structures may consist of PE/tielayer/nylon/EVOH/nylon/tie-layer/PE resins. In this market, PE films are typically laminated to other substrates, including oriented polyester, OPP, cellophane and PVDC films.

MY TWO CENTS

Among those film processors profiled by Mastio, three of them—Bemis North America; Winpak Ltd. (Winpak Films, Inc. Div.); and Sealed Air Corp. (Cryovac Div.)—collectively held 76.4% of the cheese-film market in 2014. These are considered by many to be among the elite in film processing. This is a fairly small market and, ironically, improved economic conditions can actually adversely impact it. That's because when the economy is good, people tend to eat out more and thus buy less pre-packaged food,

Related Content

For Extrusion and Injection-Blow Molders, Numerous Upgrades in Machines and Services

Uniloy is revising its machinery lines across the board and strengthening after-sales services in tooling maintenance, spare parts and tech service.

Read MoreFlexible-Film Processor Optimizes All-PE Food Packaging

Tobe Packaging’s breakthrough was to create its Ecolefin PE multilayer film that could be applied with a specialized barrier coating.

Read MoreFirst Water Bottles With Ultrathin Glass Coating

Long used for sensitive juices and carbonated soft drinks, KHS Freshsafe PET Plasmax vapor-deposited glass coating is now providing freshness and flavor protection for PET mineral water bottles.

Read MoreCoca-Cola’s Redesign of Small PET Bottles Pushes Lightweighting Below Prior ‘Floor’

Coca-Cola thought it had reached the limits of lightweighting for its small PET carbonated soft drink bottles. But a “complete redesign” led to a further 12% reduction.

Read MoreRead Next

See Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More