Are Imported PET Preforms Likely To Hit Our Shores?

At least one expert in the global polyester industry thinks that may well be a possibility, despite some odds against it.

At least one expert in the global polyester industry thinks that may well be a possibility, despite some odds against it. Speaking at Plastics Recycling 2014 conference held last week in Orlando, this scenario was part of his overall presentation and panel discussion, which offered a detailed assessment of PET resin market price trends and what the immediate future may hold.

John Maddox has a 34-year history in PET, from resin producer and container manufacturer to his Jacksonville, Fla., consultancy SBA-CCI for which he is president. The company produces a unique macroeconomic supply/demand, precise /margin model on the global value chain and offers consulting to the global polyester industry and upstream feedstocks (PX, PTA/DMT, fibers, PET resin and film). Here’s how he characterizes the current state of the domestic PET resin with a focus on preforms and why imported preforms could pose a further dilemma.

Maddox says, there is excess PET resin, excess preform capacity for most generic sizes—like CSD (carbonated soft drinks) and water, as well as excess blow molding capacity at container suppliers like Amcor, Graham, Plastipak and Berry, and self-manufacturers like Coke and Pepsi. “In other words—related specifically to PET preforms—even those who self-manufacture their own preforms and bottles have been trying to sell-off excess capacity to merchant container suppliers.” He further points to those companies who are solely in the preform manufacturing ´óĎó´«Ă˝, noting that they are “regularly squeezed from all sides”.

Idle preform injection molding capacity creates real problems including excess people, layoffs, and higher overhead per unit. And perhaps as important—lack of PET resin purchased, says Maddox. This creates problems for the purchasing department who does not meet their purchasing commitments and this runs the risk of not getting the best price discounts. So everyone tries really hard to keep preform injection going—even, if it means “dumping-off” preforms at or near cost. Now, he sees this as the biggest hurdle for imported preforms—that they are widely available at low cost domestically.

However, Maddox points out that excess domestic capacity has not kept PET resin imports from growing, and in fact has continued since the 2005 production disruptions that resulted from the disastrous Hurricane Katrina. It can still be imported—especially to the West Coast, cheaper than domestic production being shipped to the West Coast because railcar freight west of the Rockies is at a high premium. The success of these continued PET imports lies in both their cheaper prices, adequate quality, and supply lines that were not that long.

So, will preforms start being imported too? Maddox says, his company has received emails from several companies, mostly from China or India, who think they can sell preforms in the USA. “We know for sure that Gatronova of Pakistan has world-class injection equipment and supplies preforms broadly within Pakistan. Maddox reminds us that preforms (less than 1 liter) have a bulk density similar to PET pellets, so that shipping cube is economical. He adds that there are always such issues as questions about quality, consistency, shipment delays and shipping damages, but notes that in PET resin, those same objections have been overcome.

Maddox believes that we would be naïve to think that imported preforms may not be something to contend with in near future. His justification includes the fact that excess PET capacity is also taking place in Asia and that PET resin is significantly cheaper there. Moreover, preform freight is about the same as resin freight—same weight per sea container, and they also have world-class preform manufacturing technology in place. “Damage to preforms will be the pushback, but that has proven to be a non-issue with proper handling and packing. Hundreds of millions of preforms had been shipped from the USA to Europe, the Caribbean and South America for several years before those regions installed their own capacity. So, if they can go out with no quality problems, they can also come in with no quality problems.”

Related Content

Polymer Science for Those Who Work With Plastic — Part 1: The Repeat Unit

What are the basic building blocks of plastics and how do they affect the processing of that material and its potential applications in the real world? Meet the repeat unit.

Read MorePolymer Science for Those Who Work With Plastics: Molecular Weight — What It Is and Why It Matters

Molecular weight might seem like an abstract concept, but it plays a crucial role in determining the behavior of plastics during processing and in their final applications.

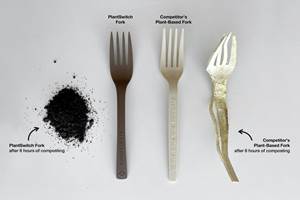

Read MoreAdvanced Biobased Materials Company PlantSwitch Gets Support for Commercialization

With participation from venture investment firm NexPoint Capital, PlantSwitch closes it $8M bridge financing round.

Read MorePrices for All Volume Resins Head Down at End of 2023

Flat-to-downward trajectory for at least this month.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More