All-Plastic Paint Cans Challenge Steel

After considerable success in Europe, all-plastic gallon paint cans are spilling into North America’s retail paint market more quickly than was anticipated just a few months ago.

After considerable success in Europe, all-plastic gallon paint cans are spilling into North America’s retail paint market more quickly than was anticipated just a few months ago. While 5-gal paint pails are virtually all plastic, steel cans still dominate the one-gallon market in North America. And though plastic-metal hybrid cans have grabbed a share of that market, recent developments now make all-plastic designs cost-effective challengers for the 1 billion metal paint cans sold annually.

The best-known introduction for all-plastic paint cans in North America is the Sherwin-Williams Dutch Boy “Twist and Pour” gallon plastic can, an extrusion blow molded HDPE container (the first in that material) with a PP lid that appears on Sherwin-Williams and Wal-Mart store shelves. The molder is North American Packaging Corp. in Lithonia, Ga. This advance was reinforced last month by the introduction of a similar container by Masterchem, a supplier of primer paints that is making its initial entry in topcoats with Kilz Casual Colors in gallon and quart HDPE cans.

These square-bodied, rounded-lid, twist-top designs fit more cans into available shelf space, a priority for mass retailers. They also incorporate ergonomic and convenience features for the predominantly female paint consumer, like injection molded handles and pour spouts, a reclosable screw cap that doubles as a paint cup, and color-coordinated labels that help consumers pick the right paint. For this project, the blow molder, Fortco Plastics, Ft. Wayne, Ind., purchased the first U.S.-built HDT 700 shuttle blow molding machine from Graham Machinery Group.

This first wave of North American all-plastic paint cans fits premium niche markets. The multi-part containers cost at least three times as much as the typical 50¢ to 60¢ steel gallon can. They also fit awkwardly into the paint industry’s current handling, filling, and tinting infrastructure designed for round steel cans.

In early 2004, two firms will launch new all-plastic concepts for direct replacement of metal cans. They are an injection molded opaque, all-PP can developed by KW Plastics of Troy, Ala., and an injection stretch-blow molded clear, one-piece PET can from the PCC Group in the U.K. Both groups plan to displace steel cans on the basis of superior cost, functionality, and manufacturability.

PET gets the ‘All-Clear’

“Round metal paint cans have been around since Napoleon and are low-cost and highly standardized,” says Richard Lawson, president of PCC Group. Yet he expects about 15% of steel cans in the U.S. to convert to his company’s PET design in the next three years. PCC’s technology, which is available for license, molds the rim into the preform, allowing one-piece PET cans for the first time to be blown on one-stage injection stretch-blow machines. The snap-in lid is also PET.

What distinguishes PET cans from PP or HDPE versions is their resistance to both water- and oil-based paints, and their ability to be either clear or colored. Until now, use of PCC’s PET cans has been mostly for precolored paints and wood stains in Europe (see PT, Aug. ’01, p. 45).

PET blow molding will transform paint packaging economics in the U.S., predicts Mi chael Hunter, president of PCC Inc., a new joint venture created to license PCC Group’s PET can technology in North America. Hunter claims a round PET can is able to drop into the existing paint-industry infrastructure with only minor modifications.

In North Ame rica, the initial commercial use of PET cans is by Innopack in Mexico City, which will launch four sizes from 250 cc to 4 liters for a Mexican customer in early 2004. Innopack is molding three sizes on a Husky one-stage Index SB-125 (125-metric-ton) machine, says Is-mael Aguilar Cano, new-product development manager. The largest size, 4L with a 165-mm neck finish, is molded on Aoki one-stage ma chines. Inno pack, a leading Mexican PET mol der of beverage containers and caps, has developed a see-through label and snap-on PE handle for the 4L cans.

PCC’s Hunter portrays Innopack’s program as opening the way to speedy adoption of PET paint cans north of the border. Hunter says another boost to PCC’s plans is work by Husky to improve its Index SB machine’s productivity.

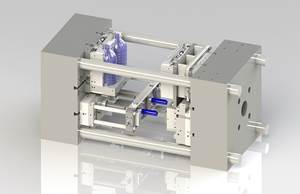

Within a year, Husky expects to expand the Index SB line with versions based on its 300- and 600-ton Index preform injection systems, says David Whiffen, Index SB ´óĎó´«Ă˝ manager. Whiffen says the larger Index SB blow molding units would expand both the output capability and cost-effectiveness of PET paint can molding. Husky is also working to adapt the existing SB-125 to make larger (4L) cans.

In addition, Husky plans to apply its expertise in turnkey systems with integrated downstream handling. Whiffen notes that the design of Index SB machines favors downstream automation by permitting cans to leave the machine in upright and oriented position.

Hybrid can goes all-PP

For about a decade, KW Plastics has supplied mass-market paint companies with millions of paint cans in a hybrid design that joins a PP body to a steel ring and lid. KW now plans to launch an all-PP paint can by mid-2004. The can body, ring, and lid will be of black, high-impact PP, though at first it will still have a snap-in metal handle. The can’s crush-resistance reportedly exceeds that of metal cans and is sufficient to stack containers up to 25 units high.

“In water-based paints, which make up 90% of U.S. sales, our injection molded all-PP paint can will exceed all other alternatives in cost-performance,” declares Brian McDaniels, KW’s national marketing director. Called Snap Lock, the two-part gallon can uses an injection molded black PP body similar to that of hybrid cans and a separate injection molded PP ring and lid. The shape of the can intentionally parallels that of the steel version so that it can fit easily into existing filling lines and in-store shaker equipment. Injection molded, snap-in PP pour spouts and handles are also in development.

The company is adding a $20-million facility to mold the new cans. It will contain mostly all-electric, six-cavity Milacron injection molding machines. The new plant will be adjacent to KW’s recycling facility, where the firm reclaims PP car-battery cases for its hybrid-can bodies. KW hopes to give customers a marketing advantage by using 100% recycled PP in the new cans and by setting up a collection system for the all-PP cans.

McDaniels says KW made a deliberate decision to design a separate PP ring rather than incorporate it in a uni-body can. “Simple is better in this critical part,” he says, arguing that assembly costs are far outweighed by superior closure precision and performance. McDaniels says the PP snap-in closure is resistant to damage despite repeated openings and closings. Further, injection molding precision makes KW’s ring and lid more airtight, leak-proof, and emission-resistant than those of any competitive container, McDaniels claims.

Related Content

At NPE, Cypet to Show Latest Achievements in Large PET Containers

Maker of one-stage ISBM machines will show off new sizes and styles of handled and stackable PET containers, including novel interlocking products.

Read MoreSACMI’s PET Bottle and Labeling Machinery Integrated Into Omnia Techologies

SACMI Bottling and Labelling are now subunits of Omnia’s ACMI.

Read MoreFirst Water Bottles With Ultrathin Glass Coating

Long used for sensitive juices and carbonated soft drinks, KHS Freshsafe PET Plasmax vapor-deposited glass coating is now providing freshness and flavor protection for PET mineral water bottles.

Read MoreBreaking News From NPE2024

Here is a firsthand report of news in injection molding, extrusion, blow molding and recycling not previously covered.

Read MoreRead Next

See Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More