Wood On Plastics: Economic Pressures Shift Consumption Patterns

While the economy has been expanding for most of the past two years, it is far from clear that it has entered a ÔÇťself-sustainingÔÇŁ phase.

Though the official data will not be available for a few more weeks, it’s safe to say that the current period of economic expansion in the U.S. will have lasted two years by the end of this second calendar quarter. According to data reported by the Dept. of Commerce’s Bureau of Economic Analysis, the last quarter in which U.S. economic activity declined was the second quarter of 2009. The GDP has registered gains ever since, with the annual growth for 2010 coming in at an inflation-adjusted rate of 2.8%. This expansion should continue through 2011 and 2012, and our latest forecast calls for a gain of 4% in GDP this year.

Good news. The bad news is that while the economy has been expanding for most of the past two years, it is far from clear that it has entered a “self-sustaining” phase. A self-sustaining recovery is a virtuous circle where rising demand leads to increases in production, which ultimately leads to more hiring. This in turn leads to more demand, and whole process continually repeats itself.

The problem at the present time is the “more hiring” part of the circle. Consumers are spending more in recent months, and U.S. industrial production and demand for exports have increased. But these trends have yet to produce a significant increase in hiring. The consensus view remains optimistic that hiring activity will accelerate soon, but it has not happened yet. There will likely be some pent-up demand that will be released once firms start adding to payrolls and consumers become more confident about their future financial situation.

Another factor that is clouding the outlook for consumer products is the ongoing sluggishness in residential construction. From a historical perspective, demand for many types of consumer products correlates strongly with spending on new homes or upgrades to existing houses. The number of new houses started in the U.S. will increase in 2011 for the first time since 2005, but the increase will be small, and we are at the bottom of a deep hole.

Another consideration for makers of consumer products will be the long-term impact of the concepts of “sustainable” or “green.” Though nobody wants to admit it now, many of the popular consumer products of the past were designed, manufactured, and marketed with an eye towards “planned obsolescence.” But the rapidly rising costs of raw materials combined with increasing awareness about disposal costs and the benefits of recycling are affecting consumption patterns. The products that save energy, enhance safety, or raise productivity are garnering more attention from an increasingly savvy marketplace.

There’s some good news for domestic manufacturers: Chinese consumers are demanding more goods, while the cost of shipping is escalating at an accelerating rate. The U.S. will continue to trade with China, but the trend in both of these markets is towards products that are produced closer to the consumer.

The consumer marketplace is changing rapidly. Many types of materials and products will either rise in price, or consumers will simply stop using them. Many sectors of the plastics industry will be hurt by this. But for those who position themselves correctly, the coming months and years will be full of opportunity.

WHAT IT MEANS TO YOU

•Think “enhancement” rather than “consumption” as you plan for the marketplace of the future. Consumers will need to get more out of their disposable dollars, so they need products that will last longer or will add some clear benefit to their lives.

•Design products that will be easy to recycle.

•Many products that migrated overseas will come back to be manufactured domestically, while some others will simply fade away. Find real needs and then fill them.

Related Content

US Merchants Makes its Mark in Injection Molding

In less than a decade in injection molding, US Merchants has acquired hundreds of machines spread across facilities in California, Texas, Virginia and Arizona, with even more growth coming.

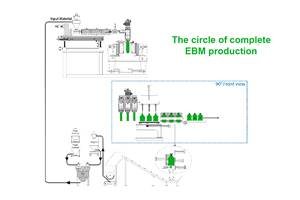

Read MoreGet Color Changes Right In Extrusion Blow Molding

Follow these best practices to minimize loss of time, material and labor during color changes in molding containers from bottles to jerrycans. The authors explore what this means for each step of the process, from raw-material infeed to handling and reprocessing tails and trim.

Read MorePHA Compound Molded into “World’s First” Biodegradable Bottle Closures

Beyond Plastic and partners have created a certified biodegradable PHA compound that can be injection molded into 38-mm closures in a sub 6-second cycle from a multicavity hot runner tool.

Read More3D Printed Spine Implants Made From PEEK Now in Production

Medical device manufacturer Curiteva is producing two families of spinal implants using a proprietary process for 3D printing porous polyether ether ketone (PEEK).

Read MoreRead Next

Beyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More