Record Robot Sales

A strong third-quarter push drove North American robot sales to a record high with three months to go and point to 2021 being the biggest year ever.

The Association for Advancing Automation (A3) reports that in the third quarter, North American companies ordered 9,928 robots valued at $513 million, figures that are up 32% and 35% respectively over the year-ago quarter, and mark the third highest quarter ever in units ordered and fifth highest in value.

Those figures pushed year-to-date robot sales to nearly 29,000 units valued at $1.48 billion. These are the best numbers ever recorded for the North American robotics market, and there are still three months to go.

A3 President Jeff Burnstein stated in a release accompanying the report that “labor shortages throughout manufacturing, logistics and virtually every industry, are encouraging companies of all sizes to turn to robotics and automation to stay productive and competitive.”

The numbers through nine months show increases of 37% and 35% respectively over the same period in 2020, and they best the previous highest record from 2017 by 5.8% and 0.5%. Burnstein says A3 sees many current users expanding their applications of robotics and automation throughout their facilities while first timers are investing in robotics industries as diverse as automotive, agriculture, construction, electronics, food processing, life sciences, metalworking, warehousing and more.

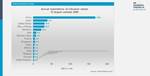

A3 looked at January-September robot orders for North American going back to 2017, the previous high, showing 2021 eclipsing that benchmark year. Source: Association for Advancing Automation.

Charge Lead by Non-Automotive Automation

In the first nine months of 2021, automotive-related orders increased 20% year over year to 12,544 units. This was outpaced by non-automotive orders, which grew 53% to 16,355 units ordered. A3 notes that this is only the second time non-automotive orders have surpassed automotive-related orders in the first nine months of a year. The previous time was actually in 2020.

In the third quarter, nearly two-thirds of sales—6302 units—came from non-automotive industries. Robot orders for plastics and rubber were up 10%, while the biggest jump came in metals, which grew 183%.

Earlier this year PT looked at the pandemic’s impact on automation, as well as the global automation market.

Related Content

-

Five Ways to Increase Productivity for Injection Molders

Faster setups, automation tools and proper training and support can go a long way.

-

BMW Group Vehicle to Adopt 3D Printed Center Console

A vehicle coming to market in 2027 will include a center console carrier manufactured through polymer robot-based large-format additive manufacturing (LFAM).

-

Real-Time Production Monitoring as Automation

As an injection molder, Windmill Plastics sought an economical production monitoring system that could help it keep tabs on its shop floor. It’s now selling the “very focused” digital supervisor it created, automating many formerly manual tasks.