Latest Reshoring Numbers Could Bode Well for Processors

Jobs resulting from reshoring and foreign direct investment set record highs in 2022 after doing the same in 2021.

I spent a good deal of time at our recent 2023 trade show (March 28-30) talking to exhibitors and attendees alike about ┤¾¤¾┤½├¢ and technology trends. I asked machine builders serving mostly the injection molding market to try to account for the spike in sales most of them experienced in 2021 and for part of 2022. I asked the same questions of processors I spotted walking the halls of the Donald A. Stephens Convention Center in Rosemont, Ill.

I knew that ┤¾¤¾┤½├¢ conditions now aren’t quite the same as they were a year or two ago. For many suppliers and processors alike, a shaky economy has injected a good dose of caution into what had been robust projections.

Still, I was excited — and a bit surprised — to hear how many of those I spoke with used the word “reshoring” to explain why ┤¾¤¾┤½├¢ had been so robust before it went into slowdown mode.

I have written repeatedly in this space that if the U.S. did not learn its lesson about having a long, winding, vulnerable supply chain as a result of everything that has gone down since Covid-19 … it never would. I wondered whether the current buzz about reshoring, like I heard at PTXPO, was just a lot of anecdotal buzz that will simmer down once the supply chain starts to untangle. Or are we looking at a true trend?

The latter possibility is supported by research recently released in the ’s 2022 Data Report. According to , 2022 reshoring and foreign direct-investment (FDI) manufacturing job announcements hit a record last year: Some 360,000 jobs were added as a result of FDI and reshoring projects, a 53% increase from the 2021 record. The numbers were buoyed by what the Reshoring Initiative described as a huge surge in EV batteries and chips, combined with a continued trend in a broad range of industries. The total number of FDI/reshoring jobs announced since 2010 is now nearly 1.6 million, according to the Reshoring Initiative. New investments in U.S. manufacturing by domestic and foreign companies surged after President Biden’s Inflation Reduction Act and Chips and Science Act were passed.

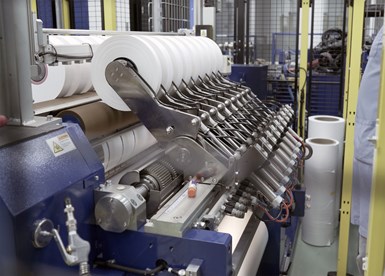

ENTEK is investing big in two new battery-separator plants to meet the demand for such films in EVs. (Photo: ENTEK)

Says the 2022 Data Report, “The underlying trend is driven by the recognition that, in many cases, the total cost of offshoring exceeds that of sourcing domestically. There have been peaks and valleys in the trend; 2017 was driven by the 2017 tax and regulatory cuts, while 2018 and 2019 declined due to the trade war. The trend resurged from 2020 to 2022 driven by companies recognizing their vulnerability to supply chain disruptions and, most recently, to geopolitical events. U.S. investments in chips and EV batteries accounted for 53% of 2022 job announcements. While the rise in the trend is boosted by the temporary artificial support of federal policy, we expect the stimulus to result in further EV battery investments and FDI of EV assembly plants. The increased chip investments will also motivate more companies to assemble electronic products here.”

We’ve seen some evidence of this in the plastics industry. At a press conference back in February, laid out details for its $1.5 billion investment to build two new battery-separator plants in the U.S. The company, which may be better known to processors for its twin-screw compounding extruder ┤¾¤¾┤½├¢, currently makes separator film at its headquarters in Lebanon, Ore., as well as at facilities in the U.K., Indonesia and Japan. A recent recipient of $200 million in government funding for this project, ENTEK plans on building plants in Terre Haute, Ind., and in Alabama. ENTEK CEO Larry Keith said the first plant will open in 2025 with two production lines and a capacity to produce 1.4 billion m2 of film, the equivalent of about 31 million lb.

Does this mean U.S.-based OEMs and brands are done doing ┤¾¤¾┤½├¢ with overseas entities on the basis of price? Doubtful. But I’d say the numbers are going in the right direction.

Related Content

A Happy Accident

Almost 25 years ago, I stumbled into a career in the plastics industry in a most happy accident.

Read MoreAttention Molders: Time to Get Serious About Sustainability

If you’re not looking at ways to make your injection molding operation more sustainable, perhaps you’d better get started.

Read MoreWelcome to our NPE2024 Show Issue

Megatrends such as sustainability are the driving force behind a slew of new product introductions at the May show. Catch up on what’s in store on the show floor right here.

Read MoreFirst Reflections of NPE2024

After a six-year hiatus, this year’s show was a resounding success, with meaningful technologies on display that will help processors run their ┤¾¤¾┤½├¢es more efficiently.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More